🗣 SL提问: Diversifiedportfolio

✍️ Ai批改: A diversified portfolio!

A diversified portfolio is an investment strategy that involves spreading investments across different asset classes, sectors, and geographic regions to minimize risk and maximize returns、The goal is to create a balanced portfolio that can weather market fluctuations and provide long-term growth.

Benefits of a Diversified Portfolio:

1、Risk Reduction: By investing in different asset classes, you can reduce your exposure to any one particular investment, thereby minimizing risk.

2、Increased Potential for Returns: Diversification can help you capture growth opportunities in various markets and sectors, potentially leading to higher returns over the long term.

3、Volatility Reduction: A diversified portfolio can help reduce the impact of market volatility, as losses in one area can be offset by gains in another.

4、Improved Liquidity: A diversified portfolio can provide more flexibility and liquidity, as you can sell assets in one area to meet financial needs or take advantage of new investment opportunities.

Types of Diversification:

1、Asset Allocation: Spread investments across different asset classes, such as:

* Stocks (equities)

* Bonds (fixed income)

* Real estate

* Commodities (e.g., gold, oil)

* Currencies

2、Sector Diversification: Invest in various sectors, such as:

* Technology

* Healthcare

* Finance

* Consumer goods

3、Geographic Diversification: Invest in different regions, such as:

* Developed markets (e.g., US, Europe)

* Emerging markets (e.g., Asia, Latin America)

4、Style Diversification: Invest in different investment styles, such as:

* Value investing

* Growth investing

* Dividend investing

Examples of Diversified Portfolios:

1、60/40 Portfolio: 60% stocks and 40% bonds

2、Balanced Index Fund: A fund that tracks a broad market index, such as the S&P 500, with a mix of stocks and bonds

3、Target Date Fund: A fund that automatically adjusts its asset allocation based on a specific retirement date or time horizon

How to Create a Diversified Portfolio:

1、Assess Your Risk Tolerance: Determine your comfort level with risk and adjust your portfolio accordingly.

2、Set Investment Goals: Define your investment objectives, such as growth, income, or capital preservation.

3、Choose a Mix of Asset Classes: Allocate investments across different asset classes, sectors, and regions.

4、Rebalance Regularly: Periodically review and adjust your portfolio to maintain your target asset allocation.

5、Consider Professional Guidance: Consult with a financial advisor or investment professional to create a customized diversified portfolio.

By following these steps and maintaining a diversified portfolio, you can potentially reduce risk, increase potential returns, and achieve your long-term investment goals.

0

IP地址: 223.142.44.48

搜索次数: 101

提问时间: 2025-04-11 11:17:08

❓️ 热门提问:

遂昌金矿图片

实物黄金价格怎么看

shfh域名注册商

怎样识别金子的真假有哪些方法

网上卖药那个网站好

淘金币怎么兑换成红包

银华长荣混合C

群聊ai

网上如何买外汇

k金的硬度是黄金的几倍

豌豆Ai站群搜索引擎系统

🤝 关于我们:

三乐Ai

作文批改

英语分析

在线翻译

拍照识图

Ai提问

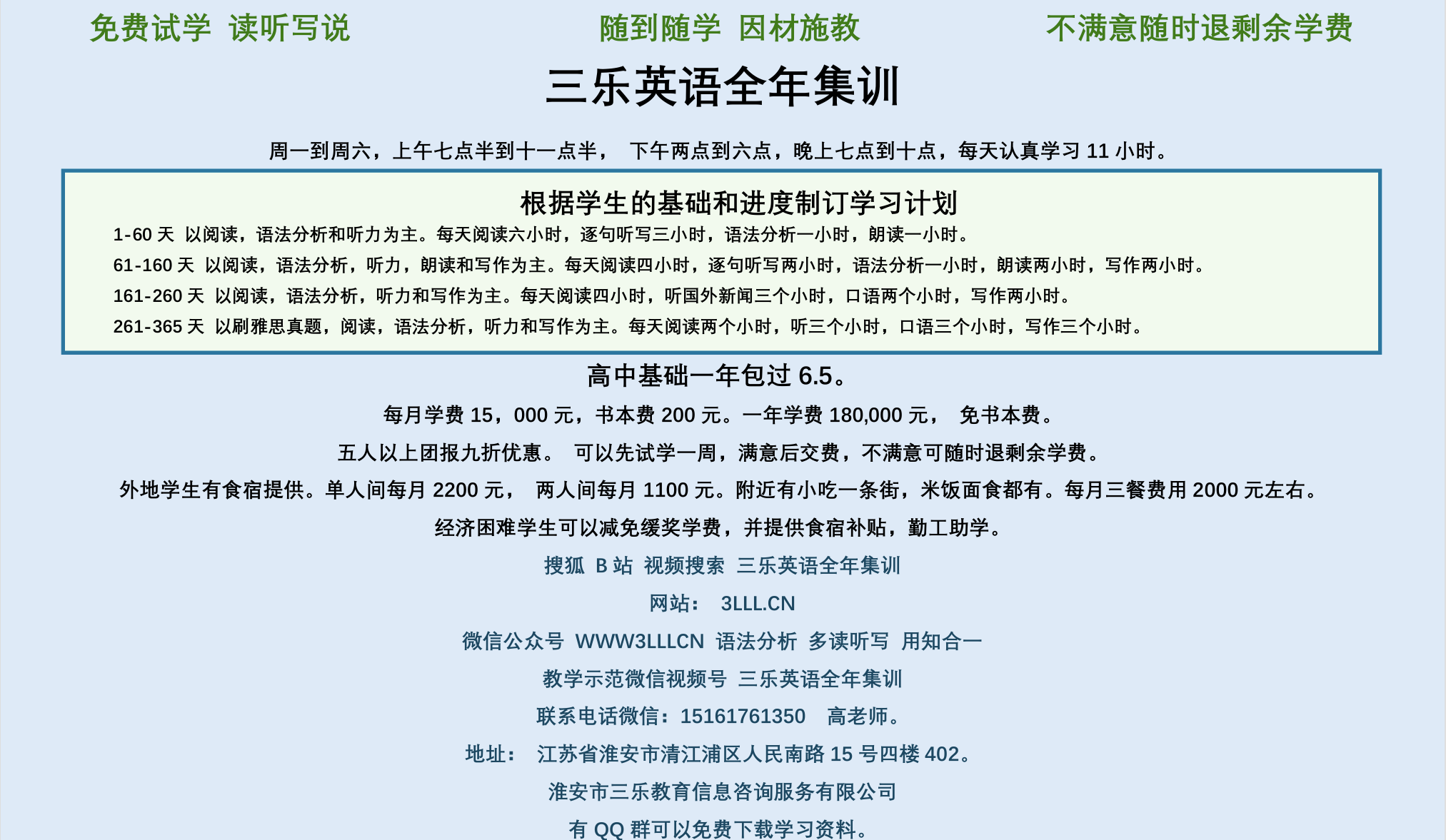

英语培训

本站流量

联系我们

📢 温馨提示:本站所有问答由Ai自动创作,内容仅供参考,若有误差请用“联系”里面信息通知我们人工修改或删除。

👉 技术支持:本站由豌豆Ai提供技术支持,使用的最新版:《豌豆Ai站群搜索引擎系统 V.25.05.20》搭建本站。